To tax, or not to tax? The question of how much to charge customers when they use a coupon is a complicated one. In most states, you pay sales tax on the total amount due before any manufacturer’s coupons are deducted. In a few states, you’re taxed on the total after all manufacturer’s coupons are deducted. When it comes to store coupons, however, it’s a lot simpler. In all states, retailer-issued coupons reduce your taxable total – you’re only supposed to be charged sales tax on your post-coupon total.

But that apparently isn’t happening at a Chicago Whole Foods Market. So a disgruntled customer is suing.

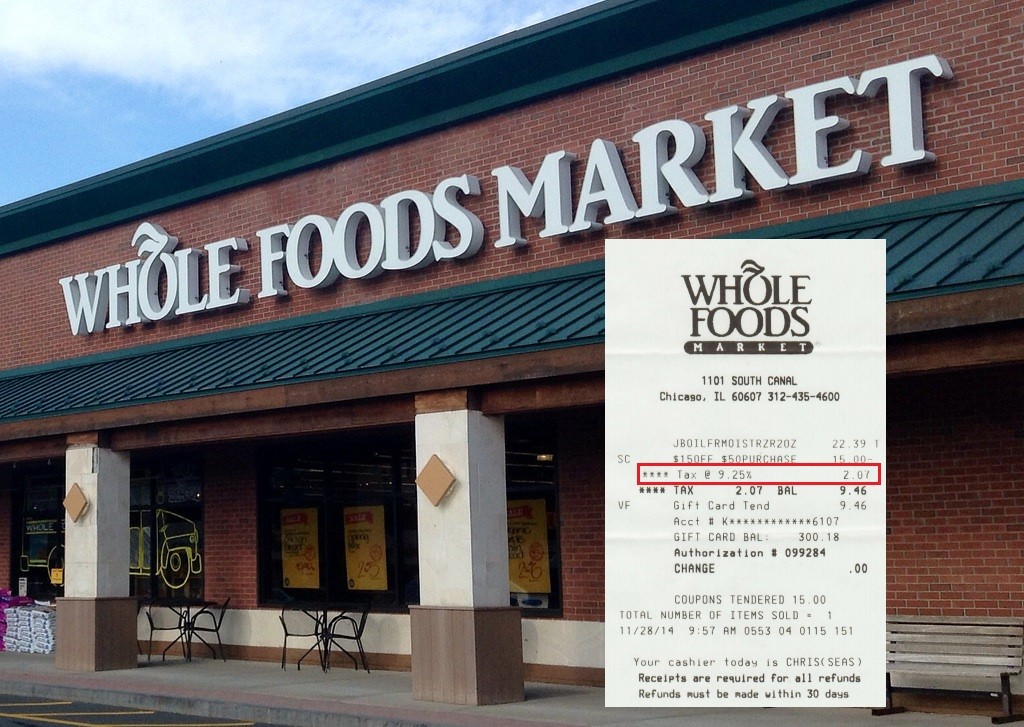

In a federal lawsuit filed Wednesday, Whole Foods shopper Chang Wong complains that he was overcharged by $1.39 when making a purchase at Whole Foods back in November. His total was $22.39, and he used a $15-off-his-total-purchase store coupon to reduce his total to $7.39. But he was taxed on the $22.39 amount, not the $7.39.

This is “unfair and deceptive,” Wong’s lawsuit asserts. He’s seeking class action status on behalf of other customers who’ve been similarly overcharged. His lawsuit seeks reimbursement of the overcharges, and damages “equal to at least 1% of the annual revenue of each of defendant’s Illinois stores during each year the violations occurred.”

So does he have a case?

Yes, and no.

Illinois’ Administrative Code is clear. “If a retailer allows a purchaser a discount from the selling price on the basis of a discount coupon for which the retailer receives no reimbursement from any source, the amount of the discount is not subject to Retailers’ Occupation Tax liability.”

In other words, if a store is reimbursed for the value of a coupon presented by a customer – as in, say, a manufacturer’s coupon – then the full selling price is considered taxable in the state of Illinois. If a store is not reimbursed for the coupon – that is, if it issues a store coupon and takes the loss itself – then it’s considered the same as having a sale, and only the discounted price is considered taxable.

So it would appear that it’s an open-and-shut case.

Except nowhere in the Administrative Code does it say that it’s actually against the law to overcollect sales tax. It only says that the pre-coupon total is “not subject to” sales tax.

Time and again, in previous, similar cases, courts have found that retailers are merely acting as tax-collecting agents on behalf of the states in which they operate. If a customer thinks they’ve been overtaxed, their beef is with the state – not the retailer. Customers seeking their few cents back have been told that they can appeal to their state for a refund of their money. “There is nothing,” a New Jersey judge once ruled in a similar case, “that creates a fiduciary duty on the part of the vendor for the benefit of the customer.”

Is it fair? Not really. Who wants to shop someplace where you know you’re going to be overcharged sales tax, and have to ask the state for a refund each and every time? It’s cumbersome and time-consuming, but most states are only too happy to allow retailers to overcollect sales tax on their behalf. And the retailers aren’t really benefiting – they’re just handing over the extra money to the state, not ripping you off and pocketing the cash.

So after paying attorneys’ fees and going through the time and expense of filing a federal lawsuit, Wong may be out a lot more than $1.39 in the end. Curiously, though, the $15 coupon in question shows up on Wong’s receipt as “$15 off a $50 purchase.” His initial purchase was only $22.39. So Wong was apparently able to save $15 after buying less than half as much as the coupon required.

So, overtaxed or not, one could argue he already got a pretty good deal.

Background image source: Mike Mozart/Flickr

Pingback: Kupon kubis? Semua makanan menawarkan diskon digital baru | Svetove Odkazy