We’ve heard by now, facts that back up what we’ve all seen – that the values and volume of coupons is down. But there are still insights to be gained from taking a close look at what coupons were offered, and used, over the past year. One report’s conclusion? We don’t like what we’re getting.

It’s that time of year when coupon industry analysts examine coupon statistics from the past year. Kantar Media was first out of the gate two weeks ago, with its findings that coupon values are going down, purchase requirements are going up (as in, “Buy 2 Get 1 Free” instead of “Buy 1 Get 1”), expiration dates are getting shorter and there are fewer coupons for food available (read more findings from that report here: “2012: A Good Year For Coupons. 2013: Even Better?”).

Now, NCH Marketing has come out with its own statistics, and its own conclusions. Its annual “Coupon Facts Report” has similar findings. But NCH also surveyed consumers to find out what they think about the types of coupons they’ve been offered. And they’re not real happy.

NCH reports that a total of 305 billion coupons were issued in 2012 – exactly the same as in 2011. Yet the redemption rate of 2.9 billion coupons was down 17% from 2011. We’re being offered the same number of coupons, but using fewer of them. So NCH asked those who said they were using fewer coupons, why?

Many of the answers come in direct response to what the statistics found. 19.4% said they’re buying more store brand products instead, while 19.5% said “coupons require me to buy too much to get savings” (see that “Buy 2 Get 1 Free” example cited above). 30.7% said they just don’t have time to clip coupons, while 39.1% said “coupons expire before I have a chance to use them” (they’ve noticed those shorter expiration dates). But the number-one answer given for using fewer coupons, cited by nearly half, was “I can’t find coupons for the products I want to buy.”

There are two key reasons for that, writes NCH Vice President of Marketing Charlie Brown. Manufacturers “increased the coupons available in non-food categories, where consumers tend to delay purchases or have a multitude of national brand and retailer private label choices.” Those of us who just want to feed our families aren’t finding coupons for all the things we need. Secondly, manufacturers shifted “more of the coupons they issued in 2012 to products that were new to the market.” There was a nearly 25% increase in coupons for things that we didn’t necessarily want to buy, but what manufacturers wanted to push us to try. “Such a significant year-over-year increase,” writes Brown, “had a direct impact on the annual coupon industry measures because even successful niche products, line extensions and start-up brands won’t typically deliver the same large-scale redemption volume as coupons offered on well-established and high market share brands.”

Those are the big takeaways from the report. But there are plenty of other interesting nuggets worth noting:

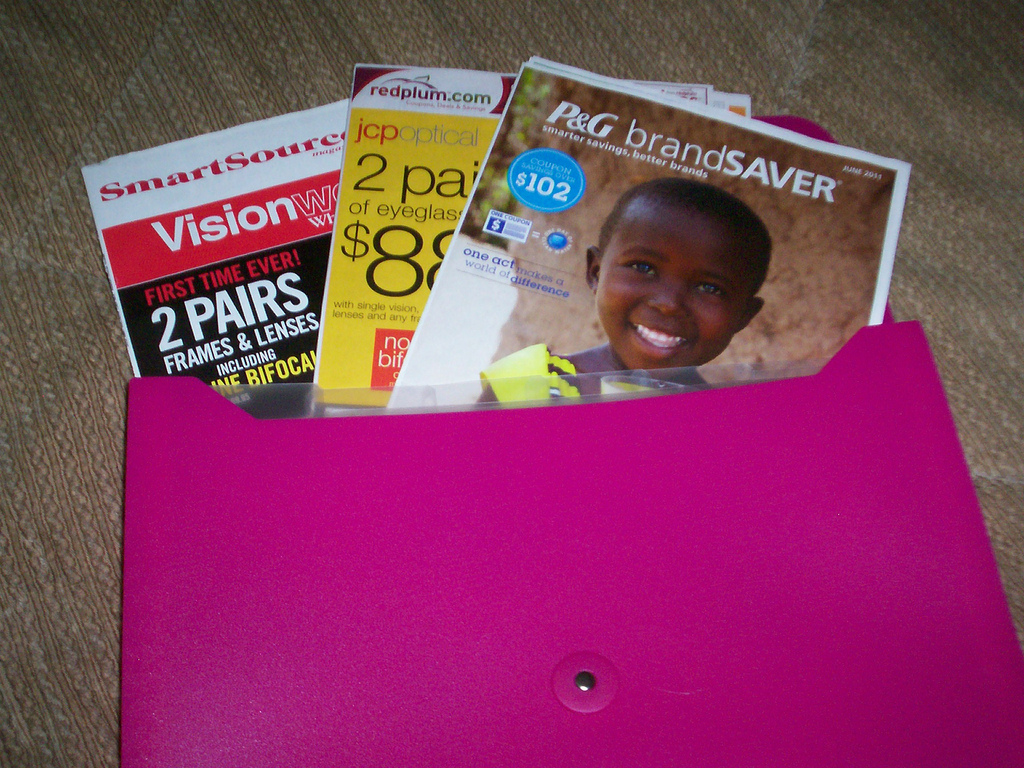

- 90% of all coupons for CPG (consumer packaged goods) items were distributed in newspaper inserts. Only 4% were offered in stores (tearpads and handouts), 1% were on or in the package itself, and only a fraction of a percent were printable.

- That tiny fraction of printables belies their popularity, though. Nearly 6% of all coupons redeemed last year were printable. Which suggests that people who print coupons, are much more likely to use them than they are other forms of coupons.

- Digital coupons also represent only about 1% of coupons offered and redeemed. Despite all the talk about digital coupons being the wave of the future – the future still seems pretty far away. “Some marketers have been swinging at nearly every ball pitched to them,” writes Brown, “looking for ways to hit a grand slam with paperless coupons, hoping to expand their audience reach wherever they can.” But the success of digital coupons will require a significant change in “consumer planning or shopping behavior.”

- Grocery stores saw an 18% decline in coupon use, but drug stores witnessed an even bigger decline, with 26.5% fewer coupons used there last year than in 2011.

- The decline in coupon values and redemption meant that manufacturers “saved $800 million” last year. That’s one way of looking at it. Another way? “It also raised the cost of per unit items that benefit from higher volume efficiencies, such as retailer redemption handling, auditing and settlement services,” writes Brown.

In the end, it seems manufacturers are still trying to achieve the right balance in the coupons they issue – making offers that are attractive to us, but profitable for them. And 2012 didn’t work out quite as well for either of us. Here’s hoping for a more profitable 2013 – for us all.

Down 17%! Wow! Big surprise.

Even with all the ‘tweaking’ that’s been done to the offers, one would assume that in this economy (& w/ Extreme Couponing still getting ratings) the use would be up. Or @ the very least-flat.

Was there a HUGE increase in prior years where this year is just a market readjustment/rebalancing?

Thanks for the article-as always: GREAT.

Thanks for reading and for all the kind comments you’ve had to offer, Barbee! You’re actually exactly right – the number of coupons available, and redeemed, shot up in 2009 and stayed up until this past year. But both figures are still higher than they were in pre-recession, pre-Extreme Couponing 2008. So you could definitely make the case that it was something of a “market correction.”

LOL You are so sweet. But be warned-don’t encourage me.

I am an opinionated sort and not shy about commenting-and I am frequently WRONG.

[Just lately I have had a streak of good luck.]