It’s not too difficult to do a grocery price comparison between two stores – you make a list, buy the same products at each store, compare prices and declare a winner. It’s as easy as that, which is why you see it done so often – and why Walmart, with its “everyday low prices”, is so often declared the winner. It’s a bit more complicated when you incorporate all of the coupons and deals available, which is why you don’t see that done quite as often. But in many cases, that’s precisely where Walmart can come up short.

That’s the case in Kantar Retail’s latest “Walmart vs. Target Pricing Study”. The price comparison, conducted twice a year since 2009, has just declared Walmart the winner for the seventh straight study. Yet, if you factor coupons into the mix, Target is the clear “low price leader.”

And you would never go grocery shopping without coupons, now, would you??

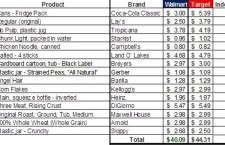

As in its eleven previous price studies, Kantar shopped at the same unnamed northeastern Walmart and Target locations, and bought the same basket of items, give or take a few that were not available this time. In all, the basket consisted of 39 identical name-brand items across three different categories (groceries, non-edible groceries and health and beauty aids).

Click on any of the images below to see a detailed list of price comparisons that were conducted in each category:

Across all three categories, the grand total at Target was $235.34, and at Walmart it was $232.55 – which means you’d save a little less than three bucks by shopping at Walmart.

Not exactly something you’re likely to see Walmart crowing about in one of its “Walmart Challenge” price-comparison commercials. Walmart won by just 1.2%, representing the smallest price gap between the two retailers since June 2012. But still, a win’s a win, right?

Unless you factor in more than just “everyday low prices”, that is. The Kantar study does take each store’s sale prices into account. But Walmart’s main selling point is that you can save there without having to worry about “gimmicks” like coupons or complicated deals. As such, “we never include coupons or basket offers as part of our pricing study,” co-author Laura Kennedy told Coupons in the News.

Walmart has the edge when it comes to manufacturer’s coupons, since it accepts them with no limit and it gives overage, while Target limits shoppers to four like coupons and adjusts down the value of any coupon that exceeds the price of the item. But unlike Walmart, Target offers plentiful store coupons – printable, paper and mobile. It also has Cartwheel percent-off discounts, gift card deals, and REDcard users get 5% off their total purchase.

When you take those into account, Target wins the price comparison by a mile. A search of various online databases shows that store coupons alone, for Listerine, Neosporin, Neutrogena, Reach, Johnson’s, Bounty, Tide and Clorox, would have saved the Kantar shopper $7 at Target during the week the survey was conducted. There was also a $5 off a $15+ personal care product purchase coupon that would have applied to Kantar’s basket. That’s a $12 savings, not even including Cartwheel offers and the REDcard discount that would have subtracted an additional $11, for a final total of $212.17 – a noteworthy 20 dollars less than Walmart’s “gimmick-free” $232.55.

Those “gimmicks” are starting to look pretty good, actually.

It’s interesting to note that all of the Target coupons available at the time were for health and beauty products, the one category that Target had already won in the pricing study. Target’s pre-coupon health and beauty basket was nearly 5% cheaper than Walmart’s. But Target’s grocery basket was more than 10% more expensive than Walmart’s, with or without coupons. “Target must address the price gap in edible grocery vs. Walmart,” the Kantar report recommends. “The size of the price gap in a frequency and impression-driving department will hamper its efforts to drive traffic.”

That said, Kantar does give props to Target’s various savings tools. Such offers and promotions are “an important indicator when it comes to the increasing personalization of price across retailers and channels,” the report reads, “that is, the idea that shoppers are ultimately not paying shelf price.”

And that, in the end, is key. Anyone can compare shelf prices. But when you’ve learned to work the system at a store to the point that the shelf price no longer matters, that’s when “everyday low prices” gains a whole new meaning. And not necessarily the one Walmart would prefer.

Hello,I read your blogs named “Why Walmart Doesn’t Really Beat Target on Prices – Coupons in the News” regularly.Your writing style is awesome, keep doing what you’re doing! And you can look our website about تحميل اغانى.

Pingback: Frugal Grocery Shopping Tips - The Frugal Vagabond