When it comes to the way sales taxes are applied, collected and in some cases, refunded, it gets so confusing, there oughta be a law!

Actually, there are several laws – but none of them seem to work out in coupon users’ favor.

In another blow to another challenge against a retailer’s alleged sloppy way of collecting sales taxes on items purchased using coupons, a New York man has lost a federal appeals court decision in his dispute with Costco.

So could the next stop be the Supreme Court?

Mark Guterman has waged a two-year battle against the club store chain, claiming that it improperly collected too much sales tax on items discounted with coupons. After a federal judge tossed his case last fall, Guterman challenged the decision. But now, the U.S. Court of Appeals for the Second Circuit has upheld the lower court judge’s ruling.

So unless he appeals that decision to the highest court in the land, it seems Costco may well be able to overcharge couponers with impunity and there’s nothing Guterman or anyone else can do about it.

The appeals court agreed with the lower court judge that New York state law already has procedures in place for consumers to apply for a refund from the state, if any store collects too much sales tax from them. The fact that those procedures may be cumbersome and unfair, both courts declared, is irrelevant.

In New York, as in most other states, store coupons are exempt from sales tax, while manufacturer’s coupons are not. So the value of any store coupons you use when making a purchase should be deducted from your subtotal before sales tax is applied.

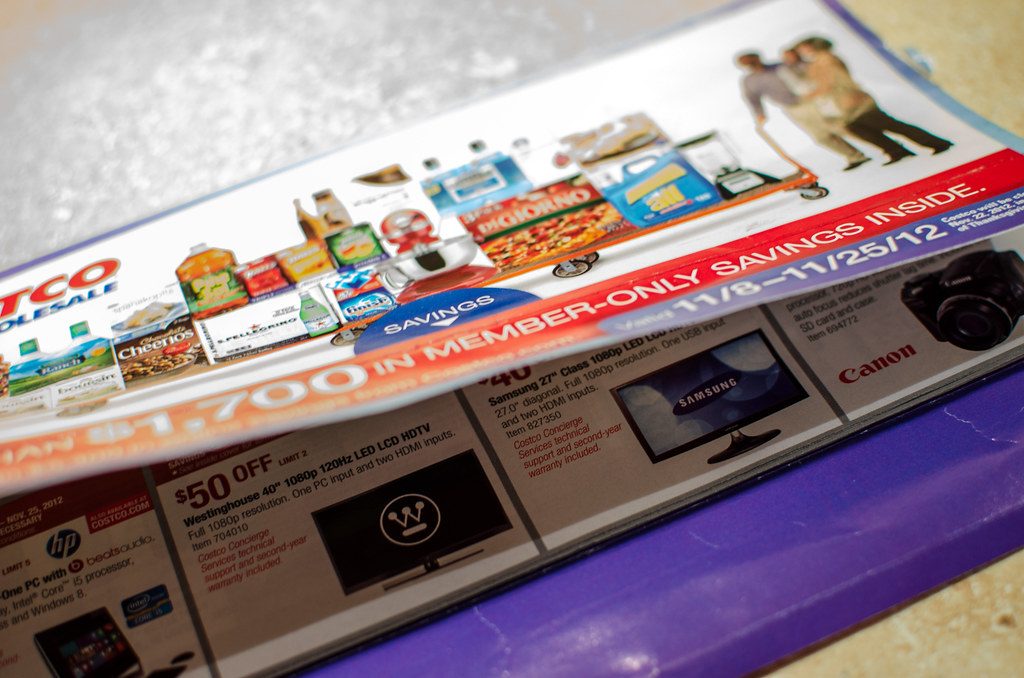

Guterman’s lawsuit pointed out that Costco’s monthly coupon books at the time didn’t specify that the coupons inside were actually manufacturer’s coupons, and subject to taxation. So he said they should have been treated as store coupons and exempt from sales tax. But purchases he made using the coupons were taxed at pre-coupon prices.

So he sued, saying that millions of shoppers were likely being overcharged by “tens of millions of dollars”. If Costco sent the proper amount of sales tax to the state after collecting too much sales tax from shoppers, that means Costco might well have been pocketing the difference.

But did the fact that Costco failed to disclose whether the coupons were manufacturer-funded discounts, automatically make them store coupons and not subject to taxation? The courts decided that was beside the point. The state says anyone who is charged too much sales tax has to apply for a refund from the State Tax Commission, not demand it from the retailer that overcharged them. Guterman challenged that procedure. Is it really practical, after all, for a shopper to fill out an application and wait for a check from the state every single time a retailer overcharges them by a few pennies? Wouldn’t it be fairer to force the retailer to follow state law in how to apply sales tax on store coupons, and not overcharge consumers in the first place?

Probably. But the law is the law, both the lower court and the appeals court ruled.

Costco “could have refunded the excess taxes” it charged Guterman – “it may even have been sound business practice” to do so, the lower court judge wrote in his decision. But while Guterman “has alleged troubling conduct by Costco, the Court cannot re-write New York law,” nor can it allow Guterman to “make an end run around” the law by filing a federal lawsuit.

And the federal appeals court agreed. Fair or not, the state’s “application-and-refund process is the exclusive remedy available for claims of unlawfully charged sales tax,” the court decided.

Different states have different laws about sales tax, and coupons, and refunds. But case after case has shown that most of these laws favor retailers and not consumers. What good are laws that say retailers can’t charge sales tax on certain coupons if they can do it anyway without being penalized, and the burden is on the consumer to pay up now and try to get their money back later?

The Supreme Court has a lot on its plate. But if Guterman isn’t ready to give up his case, and the justices are interested in deliberating over coupons, that could be just what it takes to settle this issue once and for all.

This seems like a bogus lawsuit. The “instant savings” is deducted as a manufacturer’s coupon and sadly those are taxable in New York. Their sale brochure (which I have in front of me) says that tax may be due on the pre-savings price.

For some people, reading is fundamental. He more than likely never read a single thing.