“If you can ban retailers from accepting coupons on cigarettes, what’s to stop lawmakers from banning retailers from accepting coupons on junk food?”

-Coupons In The News, “What’s Next, A Ban on Coupons? Well, Yes.” March 19, 2013

Hate to say “told you so,” but it appears that the above notion may not be so far-fetched after all.

The idea of imposing additional taxes on sugary soft drinks to discourage consumption is not a new one. A few states have implemented some form of tax, while many others have considered and abandoned the idea over the years. The proposal has popped up again this year, in states including California and Illinois.

But now, one public health advocate has upped the ante – if taxes alone don’t discourage soda consumption, maybe banning coupons and sales on soda will.

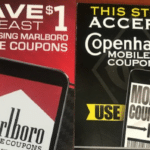

That’s precisely the argument that Providence, Rhode Island made when it banned coupons and sales on another unhealthy product – tobacco. In January 2013, the state capital began enforcing a first-of-its-kind law that bans tobacco retailers from accepting coupons on any tobacco products, or selling them at a multi-pack discount. Violators can be fined up to $500 and have their license to sell tobacco revoked. New York City went on to pass its own similar law, but enforcement is on hold as opponents challenge the ban in federal court. A court upheld the Providence law last fall, so that ban on coupons and discounts stands.

And that’s given some soda-tax advocates in California an idea. If a ban on coupons and discounts can be implemented, and upheld in court, in order to discourage tobacco consumption – why not try the same thing with soda?

They’re pointing to a recent study published in the American Journal of Public Health, entitled “Sugary Beverage Tax Policy: Lessons Learned From Tobacco.” Author Jennifer L. Pomeranz, a public health researcher and professor at Temple University, argues that soda companies opposed to increased taxes “will emulate the strategies employed by tobacco companies in their attempts to counteract the impact of such taxes,” by offering even more coupons and discounts to keep prices low. So she advocates “minimum price laws and prohibitions on coupons and discounting to accomplish the intended price increase.”

Few couponers actually pay today’s retail price of around two bucks for a 2-liter of soda, or well over $5 for a 12-pack of cans. But if Pomeranz and her followers have their way, you could be paying that regularly – plus tax.

Would that discourage you from buying as much soda as you might now? If so, that’s precisely the point. “Banning the redemption of coupons and multipack discounts reduces tobacco use among price-sensitive individuals and especially among young people,” Pomeranz wrote of Providence’s law. “The same rationale is applicable to sugary beverages.”

Of course, one key difference is that coupons and sales on tobacco products are already relatively rare. You don’t find tobacco coupons in your weekly newspaper inserts, for example, and retailers don’t regularly advertise big sales on cigarettes in their weekly flyers.

Soda coupons and sales, however, are everywhere, since the product is often sold as a loss leader. Recent data from Nielsen showed that more than half of all soda sold in the country, is sold at a discount – either when it’s on sale, when it’s purchased with a coupon, or both.

So forcing consumers to purchase soda at full price, plus a higher tax, could have a significant impact on many shoppers’ grocery budgets. And if a coupons-and-sales ban is implemented on soda, what’s to stop it from happening to candy, snacks or just about anything other than, say, granola or organic produce?

Supporters of such an idea might want to consider this – in a bizarre story out of Chicago last month, in a state that’s considering additional taxes on soda, a man became particularly enraged at the idea of having to pay any tax on his soda at all. Police say 36-year-old Nahshon Shelton picked up a $1.79 2-liter of Pepsi at a neighborhood convenience store, but didn’t want to pay a penny more. When he was asked to pay an additional 22 cents in tax, he allegedly pulled out a submachine gun instead. “This is my neighborhood,” police said he proclaimed, “I’m tax exempt!”

Instead, obviously, he was arrested. But just imagine the scene if he was told he couldn’t use a coupon, either.

If that scenario seems far-fetched, well, so did the idea of banning coupons on soda, not too very long ago.

Image source: Mr Thinktank

I really “think” this whole thing about banning coupons and highering taxes on soda is crazy. And not allowing retailers to have sales on sodas that’s crazy.I DON’T understand what’s all the fuss about what we all want to consume for ourselves. Soon these crazies will move on to picking on “something” else…By the way I still see “Alcohol products “advertised on sale but, to these crazies they have in their heads soda is far worse I suppose than any “Alcoholic product “.They probably haven’t mentioned banning those sale items because, it might be hitting a nerve for a lot of them.That’s probably their choice of drink instead of soda!!

I am for and not for this, mainly for it because people tend to abuse the 12 can case sales buying anywhere from 10 to 25 cases of there favorite soda and i think this bad should only be on high price soda items like 12 can cases of soda, other sizes like 2 liters should be used with coupons .

and i am not for this mainly because i don’t really care about it !

Pingback: No Coupons On Soda - Not Good News For Anybody

If over half of soda products are purchased at a discount, then I think this would run soda companies out of business. This is also why I don’t think this law/idea could pass in many states. Pepsi and Coke have a certain amount of power and would fight this kind of thing tooth and nail. I have to admit, I only buy 2 liters at $1, or make some Crystal Light or something and I only buy cans $3 a 12 pack and tend to pay less. It would sure end my soda business, except for the occasional splurge, or maybe for my hubby and son to take to work/school with lunch only.