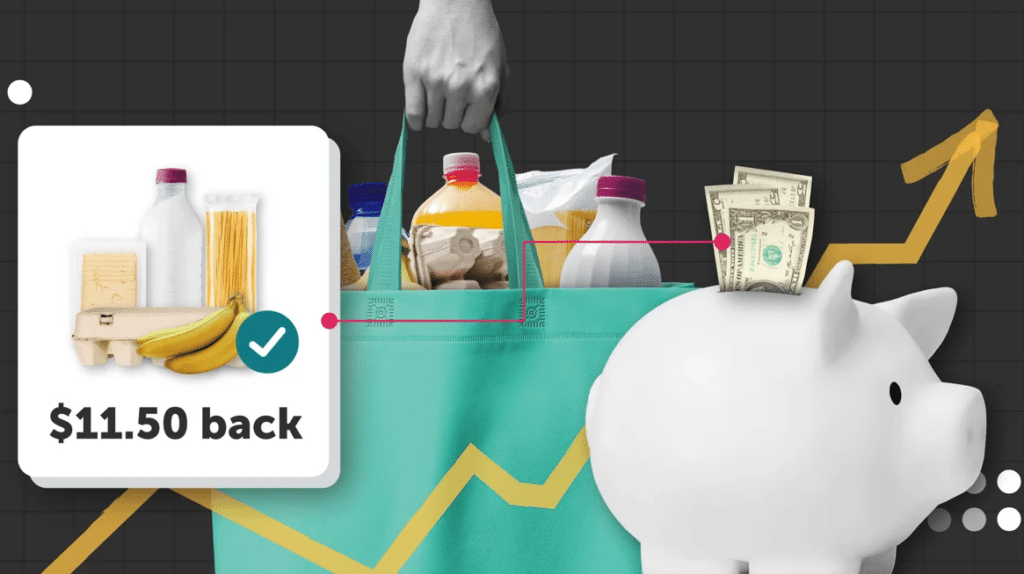

Shoppers want savings – and if brands don’t offer enough, they risk losing their deal-seeking customers for good.

That’s been a common refrain ever since the Covid pandemic and subsequent inflation sent our grocery bills soaring. But a new report offers new insights, in comparing what shoppers want with what marketers think, to find out where they agree, and where there’s a disconnect.

Ibotta has released its second annual State of Spend Report, in which it surveyed more than 5,000 grocery shoppers and more than 400 brand marketers. It found that shoppers are concerned about the economy, while marketers are more optimistic. Shoppers say promotions make brands seem more valuable, while brands worry deals make them look cheap. Shoppers are still using paper coupons, while marketers predict they’ll be obsolete soon. And despite the growing prevalence of cash-back offers, a majority of shoppers still prefer coupons.

Now to break down those areas of disagreement, beginning with overall sentiments about the economy. While shoppers are slightly more optimistic in their economic outlook this year, 72% still say the economy has directly impacted their grocery spending habits. The average shopper is spending $300 more per year on food and beverages alone, not even including household essentials and personal care items, so “saving money on groceries remains a top priority for consumers,” Ibotta found.

Marketers are somewhat more optimistic, however. While only 21% of shoppers rate the state of the economy as “good” or “excellent” – little changed from last year – 33% of marketers feel that way, up 11% from last year.

A majority of shoppers say they’re responding to higher prices by trading down to lower-priced alternatives. When there are no promotions available for the brands they typically buy, they’ll try something else, including store brands. And that, Ibotta says, should be a warning sign to national brands. “At a time when private labels are expanding their presence in an effort to fulfill consumers’ demands for lower-priced alternatives,” the report reads, “it’s more critical than ever for marketers to meet consumers where they are.”

Many brands prefer to think of their products as being worth paying for, no discounts necessary. But that’s another area where brands and shoppers seem to disagree. 76% of shoppers told Ibotta that promotions make them think of a brand as being more valuable, compared to 64% of marketers, a 12-point disconnect. The rest of the marketers surveyed, 36% of them, said promotions are likely to make shoppers think a brand is “cheap.” This is “in stark contrast to consumers’ actual beliefs about promotions, which are overwhelmingly positive,” Ibotta notes, suggesting that marketers hesitant to offer promotions “may be underestimating their power.”

For those brands that are offering promotions, digital offers are still the number-one way shoppers are saving on their groceries. 62% said they have used digital coupons, cash back offers or loyalty program discounts over the past month. But that doesn’t mean shoppers are turning their backs on old-fashioned paper coupons – 28% said they’ve used printed coupons in the past month as well.

Compare that to marketers’ more pessimistic outlook on paper coupons. Similar to Ibotta’s findings last year, 81% of marketers said they believe paper coupons will be completely obsolete within the next decade. 82% believe digital promotions will continue to rise in importance, and 26% are already spending more on digital promotions than they were last year. “With the help of artificial intelligence and other innovative technologies,” Ibotta notes, “digital promotions are getting smarter and more personalized, which will undoubtedly lead to greater investments in the years to come.”

Finally, there’s the matter of coupons versus cash back. 55% of shoppers still prefer coupons that offer immediate savings, to cash back received after a purchase. A majority of shoppers say coupons have led them to buy more of an item than they otherwise might have, and nearly two-thirds still expect brands to offer coupons regardless of whether they also offer cash back.

So it’s a good thing that Ibotta offers both. Lest anyone think the survey is biased in favor of cash back, Ibotta has recently been working with some retailers to present its cash-back offers in the form of digital coupons, for those who’d rather offer discounts in a more traditional way. That said, the Ibotta report does manage to point out where cash back has some advantages. Shoppers say cash back offers are more likely than coupons to get them to try a new brand or recommend a brand to others. 71% say cash back offers “make them feel valued as a customer,” and 70% say cash back “makes grocery shopping fun,” compared to 62% who say the same about coupons.

Ultimately, shoppers are happy with savings however they can get them. “Regardless of offer type, consumers are clear in their expectations,” Ibotta concludes. “They want savings on everyday items — things they already buy and that are relevant to their needs — and they want the redemption process to be clear and simple.” For brands holding back on promotions, “the cost of inaction is steep.” Discounts may be paper or digital, coupons or cash back, but brands that don’t offer any discounts at all may be in for an unpleasant surprise, when their once-loyal customers switch to brands that do.

Image source: Ibotta