As many of us make last-minute plans for tomorrow’s holiday feast, many more are making plans for the holiday shopping to follow.

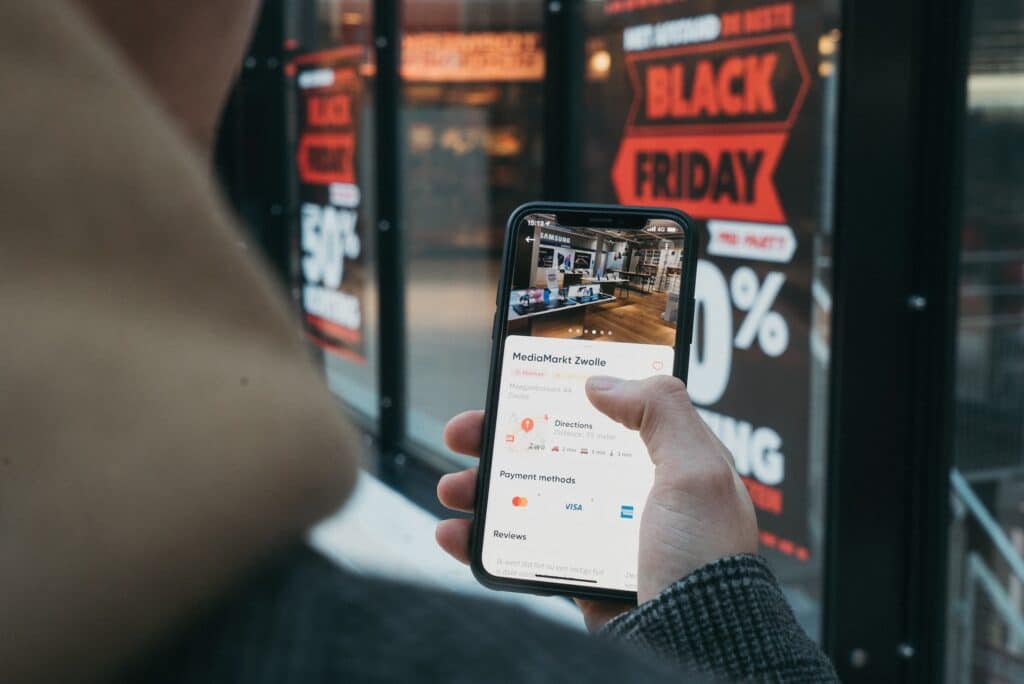

From Thanksgiving Day tomorrow, into Black Friday, through the weekend and into Cyber Monday, the National Retail Federation estimates that a record 182 million people will shop in-store and online this long holiday weekend, contributing to a record level of overall holiday spending approaching a mind-boggling one trillion dollars.

That could be great news for retailers, and for economists who are closely watching the rate of consumer spending to help gauge the health of the overall economy.

But are these record levels of shopping and spending a sign of a confident consumer, or a consumer giving into the perceived necessity of buying holiday gifts no matter their financial situation?

While a number of surveys have indicated that shoppers are ready to spend, retailers have been expressing a more cautious outlook, fearing that inflation on everyday necessities will have an impact on shoppers’ ability to afford as many holiday gifts as they used to. “Consumer demand has been even more uneven and difficult to predict,” Best Buy CEO Corie Barry told investors yesterday. “Consumers are very deal focused,” she went on, and as a result, “the level of industry promotions and discounts” are already higher than last year and higher than the pre-pandemic 2019 holiday season.

And unlike other times of year, when you might have to go hunting for coupons in order to get a lower price on whatever you want to buy, the deals this holiday weekend tend to be across-the-board discounts, with online retailers promoting coupon codes right on their homepage – all the better to turn curious visitors into paying customers.

Many retailers began offering Black Friday deals early this year to help jump-start spending, but Black Friday itself still looms large on most shoppers’ holiday shopping calendar. A recent survey by the online deals site Slickdeals found that 87% of respondents plan to shop during sales events this holiday weekend.

A separate survey by the financial services company Klarna found that shopping during holiday sales events is the top money-saving strategy for two-thirds of holiday shoppers. Half rely on coupons, while millennials are more likely to embrace “modern shopping hacks” like shopping and savings apps and price comparison tools.

All of these sales and deals and the pressure to buy could prove to be too much of a good thing for some shoppers, though. Slickdeals’ survey found that a quarter of all shoppers are already feeling somewhat overwhelmed. They say they’re feeling burnout from retailers’ early sale events, and we haven’t even gotten to Black Friday weekend yet.

And burnout is the least of some shoppers’ concerns. One final survey, by U.S. News & World Report, found that one in five shoppers plan to pay for their holiday shopping by carrying a balance on a credit card. About the same number say they’re still working to pay off credit card debt from last year’s holiday season.

So the deals this holiday weekend may be tempting. And shopping and spending levels may indeed reach record levels. But come January, gas and groceries and other necessities will still cost about as much as they do today. So shoppers who took advantage of holiday deals, may find themselves in need of savings more than ever once the holiday season comes to an end.

Image source: CardMapr.nl on Unsplash