In recent weeks, notices have been going up in Walmart stores, on Walmart’s website, on walmartcouponclassaction.com and even on the bottom of Walmart receipts – you may be entitled to a cash settlement, if you’ve used a coupon at Walmart any time over the past decade.

But don’t count your money just yet. The notices are only going up in the state of Pennsylvania, and it all hinges on the outcome of a lawsuit that could still be years away from concluding.

Brian Farneth of Verona, Pennsylvania sued Walmart back in 2013. He said Walmart overcharged him by improperly collecting sales tax on a purchase he made with a coupon. The dispute has dragged on for five years, and now the judge in the case has granted it class-action status and has authorized Farneth to notify other Walmart couponers in the state that they may be eligible to share in any settlement.

But first, Walmart would have to agree to settle the case – which it hasn’t. Otherwise, the case will go to trial. And, judging by what’s happened to others in his position, Farneth faces an uphill battle in getting any money for himself – or for anyone else.

It all started when Farneth went to a Pittsburgh Walmart in June 2013, with a “buy one get one free” coupon for Gillette shaving gel. He went to the register with his two cans of shaving gel, priced at $2.97 apiece, and used his coupon to get one of them for free. But he noticed that he was charged sales tax on his pre-coupon total of $5.94 instead of the $2.97 he owed out of pocket. The difference was only a matter of 21 cents. But multiply that by every shopper using a coupon, and Farneth argued Walmart could be skimming “several million dollars” from any number of unsuspecting couponers.

Farneth’s residency is important, because Pennsylvania is one of only five states where retailers must apply sales tax after coupons are applied, not before. (Connecticut, Massachusetts, Missouri and Texas are the others). In all other states, it works just as it did for Farneth that day in Pittsburgh. A shopper in New York, or California, or Illinois, or Florida, or just about any other state would pay tax on the selling price of an item, not the post-coupon price.

So Farneth sued. “Walmart was required, but failed, to deduct the amount of the coupon from the taxable portion of Plaintiff Farneth’s purchase price,” his 2013 lawsuit reads. Walmart’s overcharge was “illegal, unjustified and intentional” he argued – and if it “was not deliberate, it is the result of gross neglect on the part of Walmart”.

The case took a detour through federal court for half a year before landing back in an Allegheny County courtroom, where the two sides have been arguing it out ever since.

Walmart’s defense hinges on a number of factors. First is the way Pennsylvania state tax law is written. According to the Pennsylvania Department of Revenue, “the regulations require a retailer to deduct the coupon amount from the taxable portion of the purchase price, if the cash register receipt describes both the item purchased and the coupon that applies to it.” Farneth argued that since the UPC of the items he purchased, and the UPC of the coupon, were printed on his receipt, it was clear to which item the coupon was applied.

But Walmart said it reached out to the Department of Revenue, and was told that using the UPC code as an identifier is not sufficient to match a coupon to a specific product. “Therefore, the taxable purchase price should not be reduced,” the Department concluded.

Walmart also notes that Farneth successfully appealed to the Department of Revenue to get his 21 cents back. So he has no case against Walmart anymore, the retailer argues, even though he’s still seeking damages. Walmart is merely acting as an agent of the state in collecting sales tax, Walmart says, so appealing any tax overcharge directly to the state is the proper course of action, not suing the store collecting sales tax on the state’s behalf.

Several similar lawsuits have ended just that way, with judges agreeing that the only recourse overcharged couponers have, is to appeal to the state for a tax refund. But who’s really going to file an appeal with the state each and every time they go shopping at Walmart with coupons?

That places an unfair burden on the consumer while enriching the retailer, Farneth notes – because as consideration for acting as the state’s tax collector, Walmart gets to keep a 1% commission on the total sales tax it collects. So Walmart has an incentive to overcollect, Farneth alleges – because the more sales tax Walmart charges, the more money it gets as a commission.

Meanwhile, by refunding Farneth his 21 cents, the Department of Revenue must have been able to figure out from his receipt what coupon was applied to what purchase. So why did the Department tell Walmart that it couldn’t decipher the store’s receipts in precisely that way?

In a motion filed with the court last month, Farneth expressed frustration that the case was still not resolved, and accused Walmart of dragging out the proceedings with unnecessary objections and requests for extensions. “This class action has been pending for nearly 5 years, and has languished due in large part to Walmart’s delay,” he argued. “It is respectfully submitted that the best way to bring justice and resolution for the millions of consumers affected by Walmart’s conduct is to schedule a trial on the merits as soon as practical after Notice to the Class.”

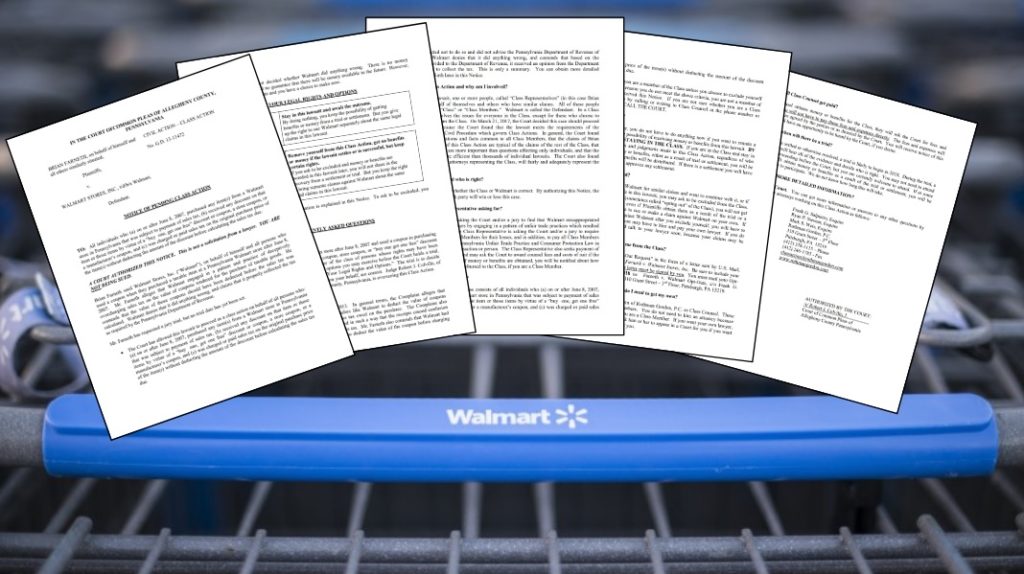

And that brings us to the present day – with the Notice to the Class now posted for all Pennsylvania Walmart shoppers to see. If you’ve seen it, and believe you’ve been overcharged while couponing at Walmart, there’s nothing you need to do right now. The notice simply informs Walmart shoppers about the existence of the lawsuit, saying they may be eligible to join the class action and share in any settlement if they were overtaxed on a purchase using a coupon, at any time on or after June 8, 2007.

“The Court has not decided whether Walmart did anything wrong,” the notice reads. “There is no money available now, and no guarantee that there will be money available in the future. However, you have legal rights and you have a choice to make now.”

That choice is to opt out of the class action and preserve your right to file your own lawsuit if you choose, or do nothing and automatically become a part of the class action, and give up your right to sue on your own.

A trial date has not yet been set. And if the case does go to trial, Farneth will have to convince the court that his argument has more merit than so many similar cases that have ended with states, retailers and consumers pointing fingers at each other and consumers ending up with the short end of the stick. And even if Farneth wins, or Walmart decides to settle the case, it could take years before anyone sees any money – just ask anyone who’s still waiting for their share of that StarKist tuna settlement.

So if you live in Pennsylvania, don’t get your hopes up for a windfall quite yet. But now that you’ve seen the notices, and while you wait for an outcome to this dispute, better hang onto your Walmart receipts – just in case.

Background image source: Walmart

I have used hundreds of coupons.

This is a well need class action suit. I usually don’t buy anything at Walmart without using coupons sometimes 20 or more at a time.

Walmart just refunded me a dollar coupon because I forgot to use it when i purchased coffee. I was reading this article at the time.

They refund the whole amount on your hand and redo the transaction. They still charge you tax for the original price and refund the amount off without taxi included.

I agree I had a coupon for Pepsi for the 8pk I had coupons from the Pepsi company themselves they didn’t have what was exactly specified so I offered to pay the difference they would not let me do it. I personally wish there was a store around to go to other then Walmart unfortunately it is not possible unless I want to drive a distance. Something about they won’t get credit for it ridiculous.

In addition to these issues, Walmart is also guilty of forging totals on coupons that are left blank. I recently used a coupon for up to a $9.99 value with a small blank box that is to be filled in at checkout. Over the years I’ve watched cashiers place those coupons in to a pouch BLANK. When I jumped the manager about it, she defended the Trillion dollar company saying that the cashier will write it in at the $5.74 value of the item I got. This never happened. It wasn’t 30 seconds and the coupon went into the pouch BLANK. Now if I were a dumb person I’d assume that the value would be put in later, but my question is how! Everyone of those coupons are going back to the manufacturers filled in at max value, yet Walmart refuses to give you the max value at checkout. This is no singular incident. I’ve watched it happen almost every time I use a coupon with a blank value. Anyone else ever see this happen?

i have been at walmart on north atherton street in state with coupons.i have used for razors.up to 9.99.i have used them at least 3 coupons at this store .i have used other ones also

wow! i use coupons too . im going to watch for this. my rule of thumb is this: dont go to the manager, go straight to corporate. ive done that a number of times and i see results.