Allegations that Dollar General is regularly overcharging customers are getting a lot more interesting – and frequent. The dollar store chain is now a defendant in at least three separate lawsuits, accusing it of routinely charging more for items at the register than the price tag on the shelf indicates.

And in a new response to one of those lawsuits, Dollar General says mistakes happen – and there are better ways to rectify pricing errors than filing lawsuits.

Alleged pricing discrepancies at Dollar General first gained public notice when Ohio’s Attorney General announced it was filing a lawsuit earlier this month, accusing the retailer of engaging in a pattern of “deceptive pricing.” But, it turns out, two separate lawsuits filed by Dollar General customers – represented by the same law firm – actually preceded the Attorney General’s case.

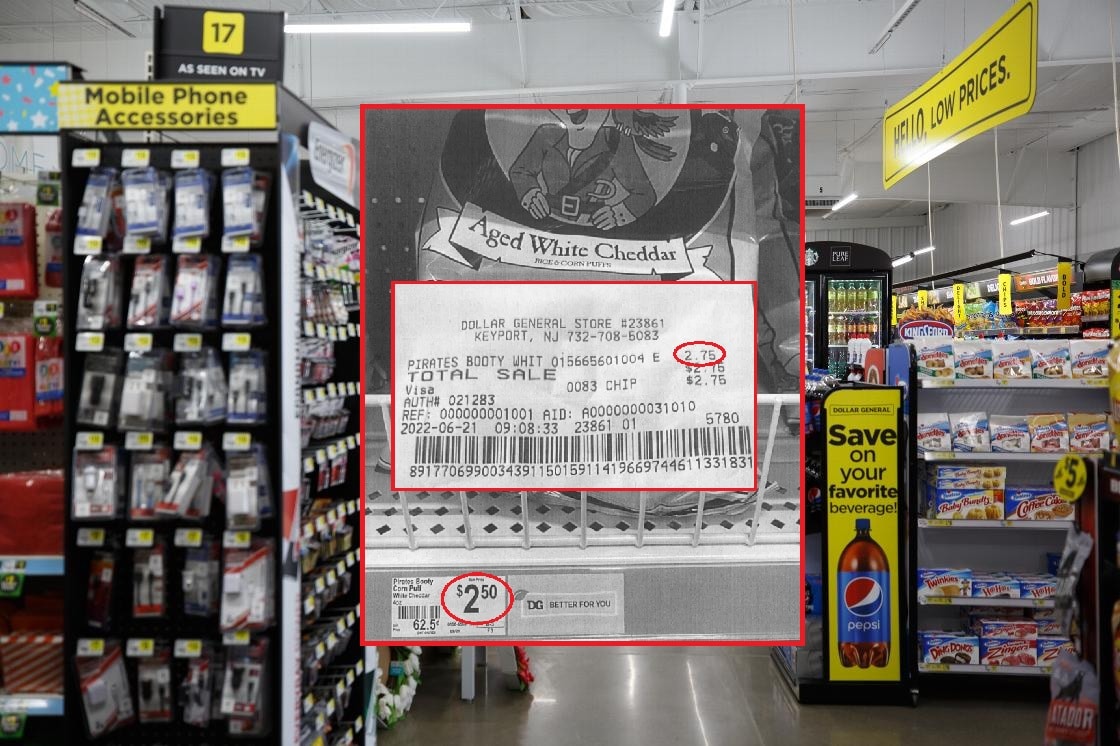

Last month, New Jersey resident Ryan Button filed a proposed class action lawsuit against the dollar store chain. A day later, Ohio resident Norman Husar did the same. Both of them accuse Dollar General of “regularly charging… a higher price at the register than the price of merchandise advertised on the shelves.”

In Button’s case, he said he would frequently shop at his local Dollar General on Saturdays, when the retailer offers a weekly “$5 off a $25 purchase” store coupon. He’d plan his purchases to just barely exceed $25 in order to qualify for the discount – but began noticing his totals were higher than they should have been. So he began keeping track, and taking photos, of the prices on the shelf and the prices he was charged at the register and on his receipts.

From May though July of this year, he says he was overcharged ten times. In one case, the shelf price for a 12-pack of Diet Dr Pepper was listed at $6.75 each, or two for $9 – and he was charged $5 for two. Most of the overcharges were minor, ranging from 5 to 75 cents, for a total overcharge of $3.50. But if those were the overcharges he noticed – what about the overcharges he, and other customers, didn’t?

Husar similarly tracked prices from July to September of this year. He shopped at seven different Dollar General stores, and noticed 16 overcharges. Most, again, were minor – typically less than $1 per item – but in percentage terms, an overcharge could be as high as 35%, as in the case of a $1 pack of gum for which he was charged $1.35.

It appears, both lawsuits concluded using identical language, that it is Dollar General’s “policy and practice to charge a higher price at the register for merchandise than the price advertised on the unit price labels for the same merchandise on the shelves.”

Dollar General so far has not responded to Button or the Ohio Attorney General’s lawsuits. But it has now responded to Husar’s accusations, claiming he was not harmed because he knew he was being overcharged, and chose to sue instead of asking for a price adjustment at the register.

“He does not allege that he ever notified any employee about these pricing discrepancies or asked Dollar General to honor the shelf prices,” Dollar General’s response reads. “Instead, Plaintiff kept quiet, continued to shop at various Dollar Generals, took 51 photographs of the shelf prices and his receipts,” and then filed his lawsuit. “Such behavior is not consistent with being surprised by a price discrepancy – it is consistent with entering into these purchases with eyes open and expecting a price discrepancy.”

So does the fact that Husar knew he was being overcharged absolve Dollar General of responsibility for overcharging him? Dollar General admits that it may have made mistakes. “It is virtually impossible for a retailer to have 100% accurate shelf-pricing all of the time – some error is inevitable,” its response reads.

And some of the burden of double-checking prices was on Husar himself, Dollar General claims. The cash register display showed the prices as they were being rung up, and the receipts Husar received showed the prices he paid. So if Husar was so familiar with the prices on the shelf, Dollar General said, he could have flagged the pricing discrepancies right away.

Plus, Dollar General says it already has policies in place to address just such concerns. In situations where “a difference between… prices may occur, resulting in an inadvertent overcharge to the customer,” the retailer says its policy states that “Dollar General will honor the lowest price.” Husar “could have requested that this policy apply,” Dollar General argued, or he could have taken advantage of Dollar General’s return policy.

So Husar has no case, Dollar General concludes. The price discrepancies he experienced “if true, merely reflect the real-world reality that it is virtually impossible for a retailer to match shelf pricing and scanned pricing 100% of the time for all items,” the retailer argues. “Perfection in this regard is neither plausible nor expected under the law.” The law allows for a pricing error rate of up to 2% of all items offered for sale, and Dollar General says Husar’s lawsuit fails to show that any alleged price errors exceed that level.

The lawsuit from Ohio’s Attorney General makes precisely that claim. But Dollar General hasn’t responded to that one yet.

In Husar’s case, he’s accusing Dollar General of violating several consumer protection laws, and unjust enrichment. He’s seeking class action status on behalf of himself and any other affected Ohio Dollar General shopper, plus damages to be determined at trial.

Mistakes do happen. But when are they forgivable, and when are they illegal? The answer may soon be up to a judge and jury – or, as it turns out, three judges and juries. And counting.

Image sources: Dollar General/Ryan Button

In Reddick, FL the Dollar General Store charged me $7.95 for ice cream bars and when I was in Walmart the price for the exact brand and quantity was $3.95. Unfortunately, I noticed it after I got home. I still have the receipt so I will I plan to show it to them the next time I go there. To me $4.00 is quite a big discrepancy and I have noticed at other times the prices are different then what was advertised. Dollar General is not living up to its’ name as a discount store but as a “rip-off” store.

I work at Dollar General in Georgia. This mess is all on corporate. They are so slow to send us new labels to correct prices that by the time we get them, they have already raised the prices again. And we were told not to change or correct prices, now that tune has changed suddenly. There are never more than 2 workers in the store at one time, and the workload is ridiculous. I love my manager and my team, but this corporation is absolutely the worst I have ever worked for, and I’ve been doing retail for 25 years, so I’m not new to this game. The CEO and his cronies should be ashamed of the way they treat their employees and their disregard for the customers who put them where they are. Greed never learns.

I can say prices are changing faster than employees can keep up with. But way aren’t people talking about no security in stores. No way of knowing when someone comes in or out. Theft is rising in stores with people getting desperate. I can understand people don’t want to pay higher prices especially when it doesn’t match shelf price. But I worry more for the people’s safety. Let’s talk about that.

I worked for them for 19 years. It’s people not doing their jobs. I was a store manager but spendt a lot of time cleaning up other store messes

I have a dollar general store I go to a lot (only store of any kind for miles) I have notified them of the price change and only the managers will ever change them … it’s been months and they still haven’t changed the tag but to be fair they have had some major sales lately that have delayed a lot, I see the managers working hard maybe I should remind them?

Why do you people have to sue over something so minor?? The managers, & their staff do the best they can do to try to keep the store stocked, clean, prices updated, & wait on customers!! If you think you were overcharged, tell an employee, & they will get the manager who will check to see & if you were overcharged refund the difference. I know in my store the price tags don’t stick real well to the pegs, so sometimes the newest price tag will come off. Accidents happen, people aren’t perfect there is absolutely no reason to sue Dollar General over this! All you people are doing is causing Dollar General Store employees to get paid less to start out, & weakening their chances of a raise!!! If you all keep it up you may cost them their jobs as well!! Grow up people, & stop sueing over every little thing possible it’s ridiculous!!

I stay in Memphis TN and buy supplies in the mornings at Dollar General. It has been over 4 times within 6 months that they have overcharged me and it wasn’t just a couple of cents. In my case I told the employee and they changed it, but if this is going on in Ohio and Tennessee, Dollar General needs to fix their system because they are charging way over . Imagine all the customers who come in there in all their stores,who’s not paying attention to the prices, they trying to make up for their losses or something. It needs to be investigated

It is happening at my store in Illinois as well. 4 out of 5 items I buy seem to ring up higher. The one time I brought it up the manager seemed mad so I quit making a deal but it is ridiculous

I often shop at dollar general .I bought 4 items and three of the 4 items rang at a higher price.When I asked who was the manager I had to stand in line again behind 5 more customers to speak to him. I then had to take him down every isle and point out all the prices on the items on the shelves.I pay very good attention to all the prices because I live on Social Security. and raising a set of female triplets age now 15. I then overheard the manager and employee talking about me because I brought it to their attention.I drive across town to a different one now. and warn all my family and friends about shopping there.

social

S

Sorry.. that isn’t how retail works. The obligation to provide the consumer with accurate pricing rests with the seller. DG knowingly targets lower income buyers. Some folks are barely getting by. Even a relatively small discrepancy can hurt them. It’s pretty unlikely that the well compensated upper echelon can identify…

Of course, the U.S. of A., where running to file lawsuits is the norm. Agree with Dollar General here. Pricing mistakes do happen, NO ONE can ever be 100% perfect. You bring it to the store’s attention – that way it can be corrected immediately. But someone now entering the store expecting price discrepancies, continuing to pay the higher price and not bringing it to the store’s attention, then running off to file a lawsuit – makes that person a part of the problem, not the solution.